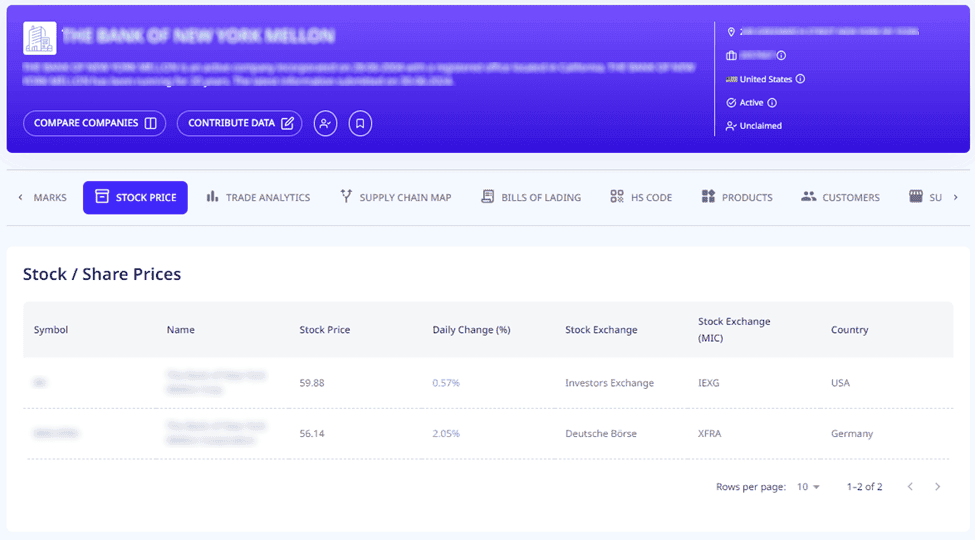

Real-Time Stock Market Information

ADAMftd provides real-time stock market information for companies, with data sourced from over 70 stock exchanges worldwide. This information is updated every few minutes, offering users up-to-date insights into stock prices, daily percentage changes, and the specific stock exchanges where the shares are traded. This feature serves as a crucial tool for due diligence, enabling users to monitor the financial performance and market dynamics of companies in real-time. By integrating stock market data into the platform, ADAMftd enhances the ability to make informed decisions regarding potential investments, partnerships, or competitive analysis, ensuring comprehensive and current financial insights.

Company Stock Search Use Cases

To make informed investment decisions and manage investment portfolios effectively.

Investors can use ADAMftd to track the stock prices and performance of companies they are interested in or have invested in. By analyzing historical and current stock prices, they can make informed decisions about buying, holding, or selling stocks to optimize their portfolios.

To evaluate the financial health and market position of competitors.

Businesses can use ADAMftd to search for the stock prices and financial performance of their competitors. This information helps in understanding competitors’ market capitalization, investor confidence, and financial stability, allowing businesses to strategize accordingly.

To assess the value of potential acquisition targets.

During M&A activities, it is crucial to evaluate the stock market performance of potential targets. ADAMftd provides comprehensive stock price data, enabling companies to accurately value the target company and make informed decisions on acquisition offers.

To plan market entry or expansion by understanding the financial landscape.

Companies looking to enter new markets or expand their operations can use ADAMftd to analyze the stock prices of key players in those markets. This helps in identifying market opportunities, understanding competitive dynamics, and assessing the financial barriers to entry.

To enhance transparency and communication with investors.

Publicly traded companies can use ADAMftd to monitor their own stock prices and the prices of industry peers. This information can be shared with investors during earnings calls, shareholder meetings, and in corporate communications to provide insights into company performance and market conditions.

To ensure compliance with financial regulations and reporting standards.

Companies and regulatory bodies can use ADAMftd to track stock market prices and ensure that all financial reporting and disclosures are accurate and compliant with regulations. This helps in maintaining transparency and avoiding legal issues related to financial misreporting.