ADAMftd Accelerates Business for Insurance Companies

ADAMftd provides a comprehensive suite of tools and intelligence that empowers insurance firms to handle the complexities of international trade with ease. By leveraging our platform, insurance companies can enhance compliance, conduct thorough risk assessments, and offer unparalleled insurance solutions.

Major Features

Comprehensive Risk Assessment – Feature Coming Soon!

Conducting thorough risk assessments is essential for insurance companies to evaluate potential clients and partners accurately. ADAMftd offers tools for in-depth risk analysis, fraud detection, and compliance verification, ensuring that every transaction is secure and compliant with international standards.

- Enhanced Risk Analysis: Perform detailed risk assessments on potential clients and partners.

- Fraud Detection: Identify and prevent fraudulent activities with advanced analytics.

- Compliance Verification: Ensure all clients and transactions comply with international trade regulations and standards.

- Insurance Underwriting: Utilize detailed risk data to inform underwriting decisions and policy terms.

Claims Verification

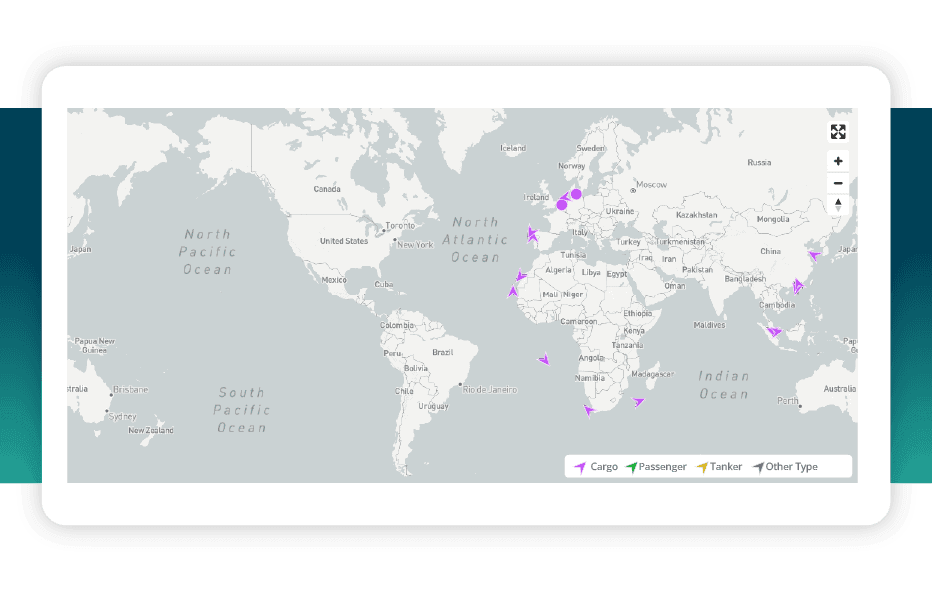

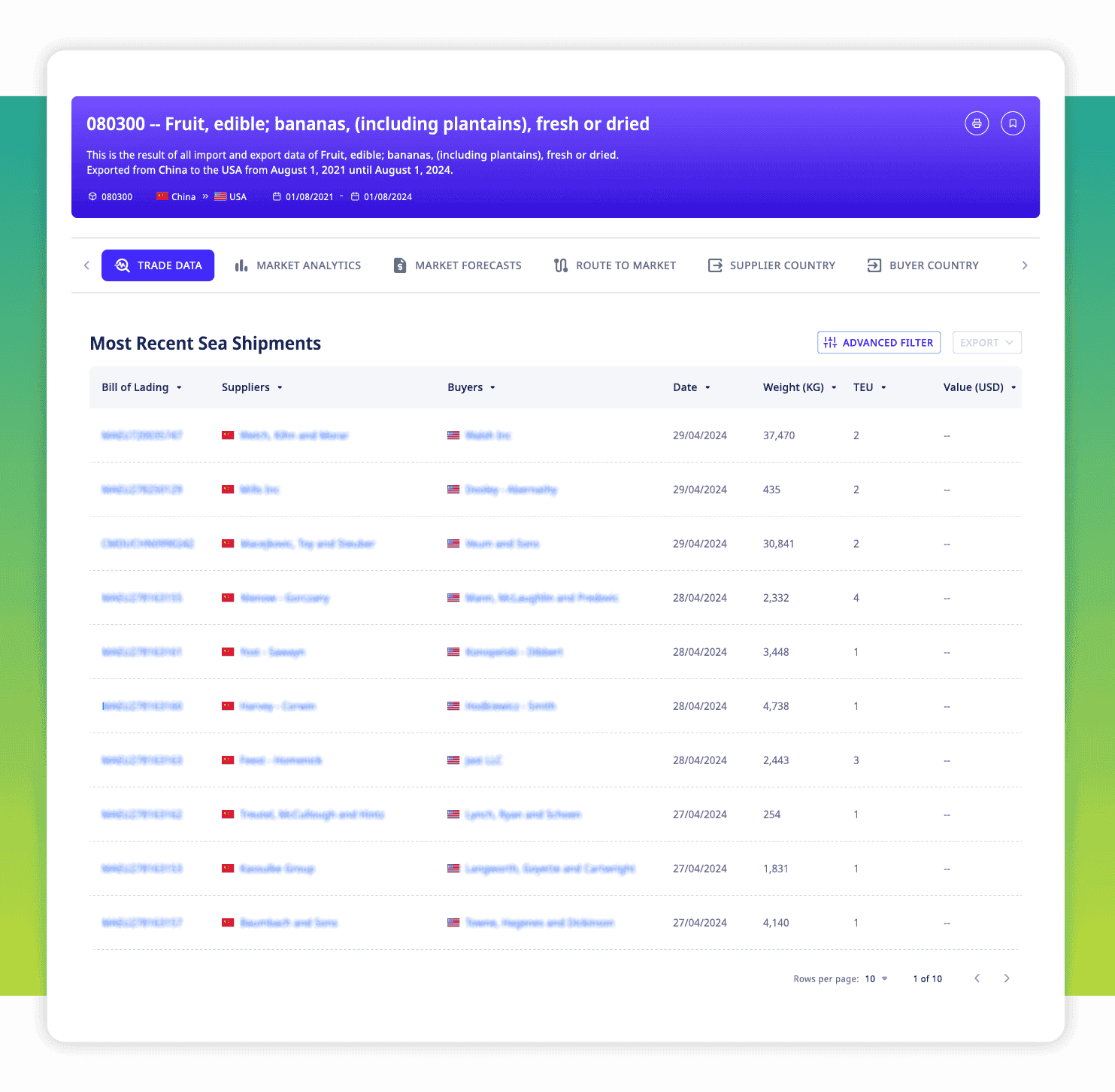

Ensuring the integrity of insurance claims is critical for insurance companies. ADAMftd provides advanced tools for claims verification, checking against customs declarations, bills of lading, and cargo details, ensuring that all claims are accurate and legitimate.

- Customs Declarations: Verify claims against official customs records to ensure accuracy.

- Bills of Lading: Cross-check cargo details and shipment documentation for consistency.

- Cargo Inspection: Validate the contents and condition of shipped goods to prevent fraudulent claims.

- Claims Auditing: Maintain detailed records of claims for transparency and accountability.

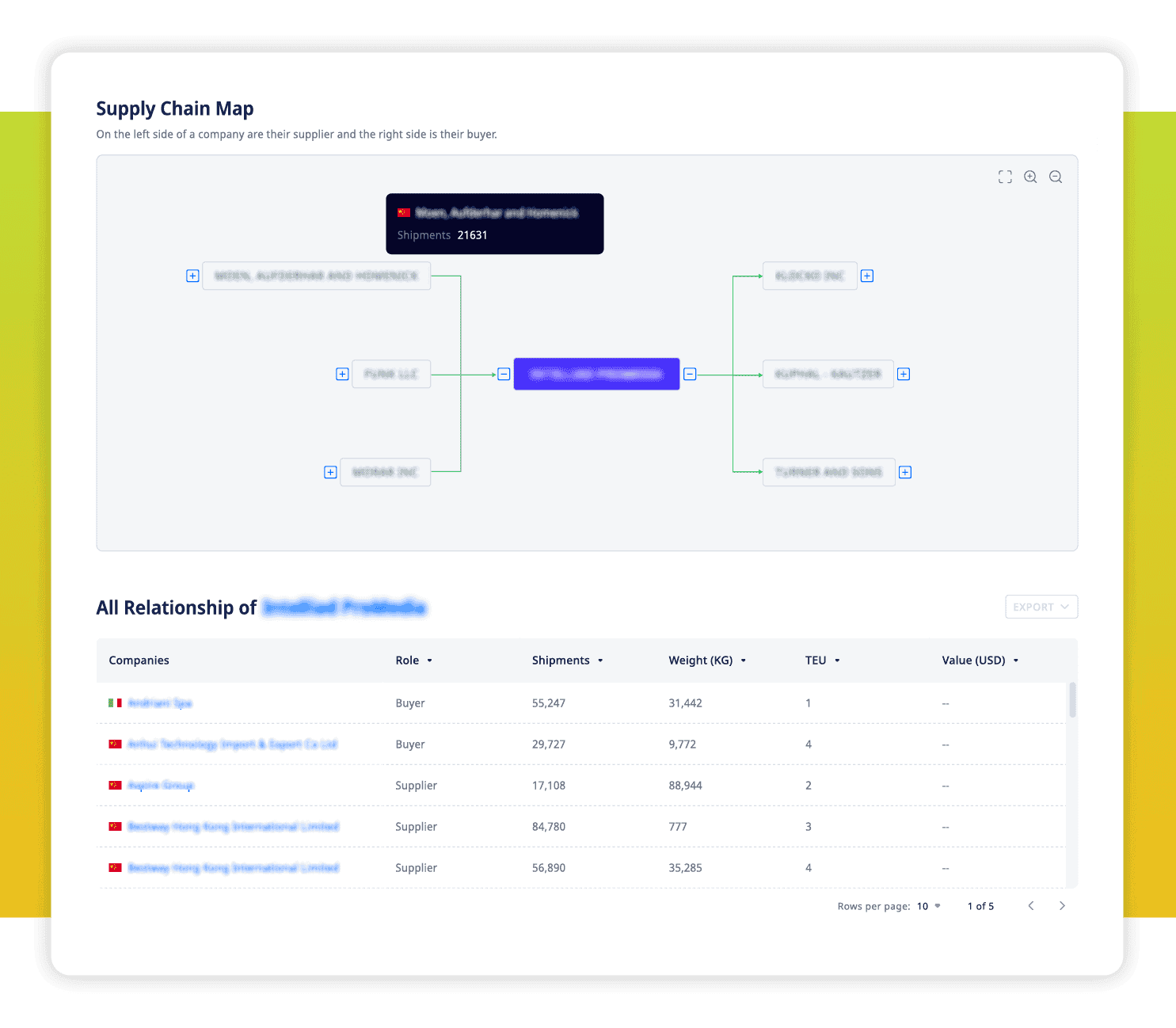

Supply Chain Transparency – Feature Coming Soon!

Understanding and monitoring supply chains are vital for managing risks and ensuring compliance. ADAMftd offers comprehensive supply chain mapping, compliance checks, and risk identification, enabling insurance companies to promote ethical practices and mitigate potential risks.

- Supply Chain Mapping: Map and monitor supply chains to identify risks and ensure ethical practices.

- Compliance Checks: Verify that supply chains comply with regulations related to human rights, environmental standards, and trade laws.

- Risk Identification: Identify potential risks in supply chains, such as exposure to sanctioned entities or conflict minerals.

- Sustainability: Promote sustainable practices within supply chains to meet environmental and ethical standards.

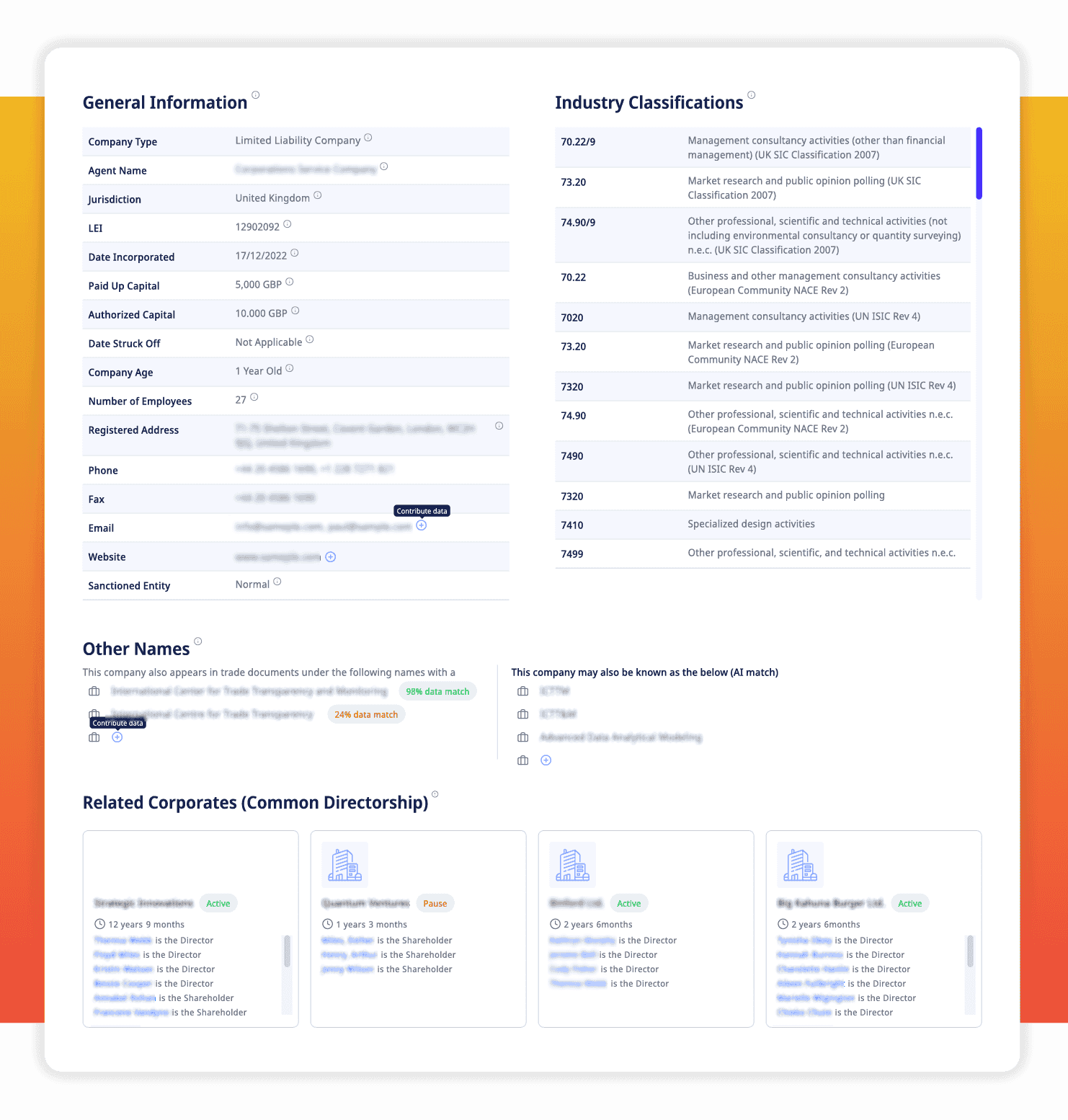

Client and Partner Validation

Validating the legitimacy and credibility of clients and partners is essential for minimizing risks. ADAMftd offers comprehensive tools for customer validation, beneficial ownership verification, negative media monitoring, and contact verification, ensuring that all business relationships are trustworthy and compliant.

- Customer Validation: Verify the identity and legitimacy of potential clients before engaging in business against official government records.

- Beneficial Ownership Verification: Identify the true owners behind companies to ensure transparency.

- Negative Media Monitoring: Monitor for any negative media coverage related to clients and partners.

- Contact Verification: Ensure the accuracy of contact information and business details.