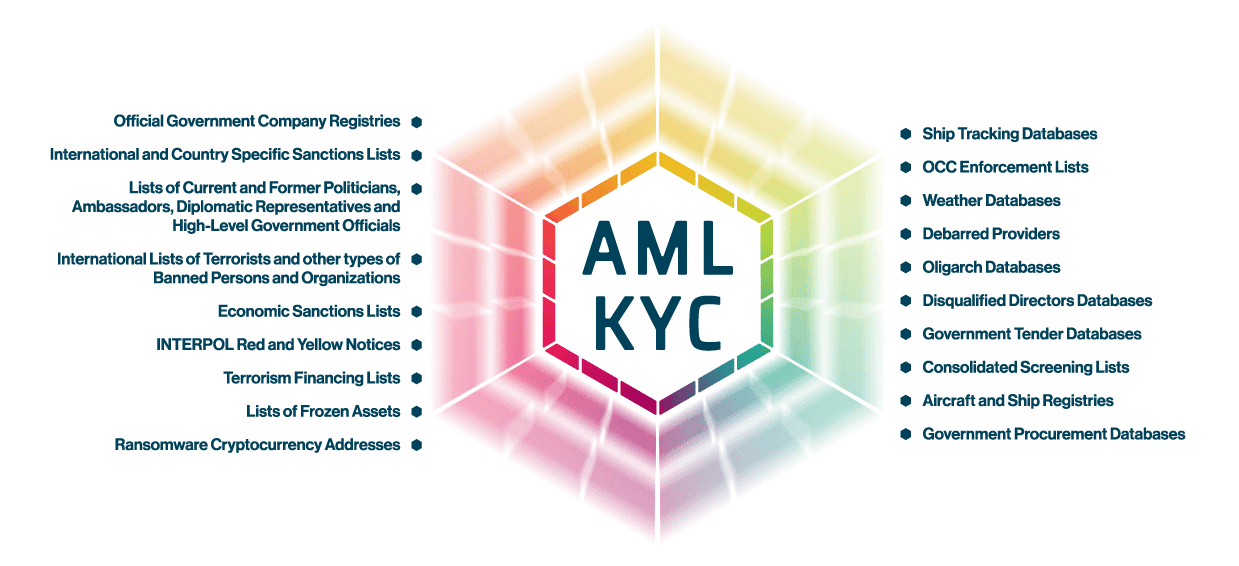

Comprehensive Sanctions Data Integration

ADAMftd excels in aggregating data from a multitude of sources related to sanctioned entities, ensuring that businesses can access this critical information through a single, user-friendly platform. By collating data from hundreds of global sanctions lists—including those maintained by the United Nations, the European Union, the U.S. Department of the Treasury’s Office of Foreign Assets Control (OFAC), and other national authorities—ADAMftd provides a comprehensive overview of entities subject to various sanctions. This extensive database allows businesses to quickly identify sanctioned companies, individuals, vessels, and assets, thereby mitigating the risk of engaging in prohibited transactions.

Real-Time Information

ADAMftd excels in aggregating data from a multitude of sources related to sanctioned entities, ensuring that businesses can access this critical information through a single, user-friendly platform. By collating data from hundreds of global sanctions lists—including those maintained by the United Nations, the European Union, the U.S. Department of the Treasury’s Office of Foreign Assets Control (OFAC), and other national authorities—ADAMftd provides a comprehensive overview of entities subject to various sanctions. This extensive database allows businesses to quickly identify sanctioned companies, individuals, vessels, and assets, thereby mitigating the risk of engaging in prohibited transactions.

Enhanced Due Diligence and Risk Management

ADAMftd’s integration of sanctions data into a single platform significantly enhances the due diligence and risk management processes for businesses operating in international markets. The platform’s advanced search functionalities and detailed reporting tools allow users to conduct thorough investigations into potential business partners, supply chain contacts, and assets. By identifying sanctioned entities and their associated networks, ADAMftd enables businesses to make informed decisions, ensuring compliance and reducing the risk of financial penalties and reputational damage. This comprehensive approach to sanctions data management supports more robust and effective risk mitigation strategies across the board.

Industries

- Banks

- Finance Companies

- Insurance Companies

- Trade Finance

- Law Enforcement

- Government Agencies

- Legislators

- Procurement Firms

- NGOs

- Venture Capital

- Public Relations

- Sanction Monitoring Bodies

- AML/KYC Bodies

- Mining

- Logistics

- Freight

- Ship Owners

- Supply Chain Management

- Government Procurement

- Maritime Law and Consulting

Sanctioned Entity Search Use Cases

Verifying Sanctioned Entity Status

By verifying whether a company, maritime vessel, or individual is a sanctioned entity, businesses can ensure compliance with international and national regulations. This helps avoid legal repercussions and penalties associated with conducting business with sanctioned entities, protecting the company’s reputation and financial standing.

Assessing Financial Exposure

Verifying the sanctioned status of entities helps in mitigating financial risks associated with potential fines, asset freezes, or transaction blockages. This proactive approach ensures that businesses do not inadvertently engage in transactions that could lead to significant financial losses or disruptions.

Maintaining Corporate Integrity

Ensuring that business partners and clients are not sanctioned entities protects the company’s reputation. Engaging with sanctioned entities can lead to negative publicity and damage public trust, so verification helps maintain a positive and trustworthy brand image.

Strengthening Due Diligence Checks

Incorporating sanctioned entity verification into due diligence processes enhances the thoroughness of background checks on potential partners, clients, and suppliers. This ensures that all business engagements are with compliant and reputable entities, reducing the risk of unforeseen complications.

Complying with Trade Regulations

Verifying sanctioned entities is crucial for businesses involved in international trade. This ensures compliance with export and import regulations, avoiding potential trade restrictions or sanctions that could impede business operations and international relations.